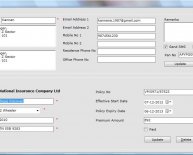

Online vehicle insurance policy

Letting your car insurance lapse can create multiple problems. When your insurance company notifies the DMV that they no longer cover your car, you are subject to a number of penalties that vary by state.

Common penalties for car insurance lapses include:

Also, remember that there are severe consequences for driving uninsured. If you are caught driving without insurance you face:

- Fines.

- Community service.

- Driver's license suspension.

- Increases of your premium.

Lastly, if you drive uninsured and cause an accident, you are financially responsible for damages and injuries that occur. Without auto insurance, these costs can add up quickly and be devastating to your finances.

Future Insurance Implications

A gap in coverage can make it difficult to get a new policy, too.

When Your Policy Expires

If you find that your car insurance policy has expired, contact your carrier right away. The agent may be able to reinstate the policy without any penalty if it has been only a few days. If the lapse has been longer, you may be unable to reinstate your policy.

Avoid driving until you get an updated insurance card. If the provider offers an online payment system, they may have a way for you to print out your new cards.

When Your Policy Was Canceled

If your policy was canceled due to nonpayment of your premium or for traffic offenses, such as excessive tickets, it's unlikely your car insurance company will be willing to reinstate your coverage.

In such cases, it might be necessary to shop for a new insurance provider. Keep in mind that if your policy was canceled, other car insurance companies in the market may look upon you less favorably and, in turn, charge you higher rates.

A lapse in insurance coverage reflects badly on you. Insurance companies base their premiums on how they rate your perceived responsibility and risk. Not having insurance suggests you are less than a responsible driver and could subject you to higher rates, classification as a “high-risk driver, " or even denial of coverage.

If you have problems getting insurance, you can try your state's automobile insurance plan. This is a state program that allows drivers who've been labeled high-risk and who've been denied insurance to be able to get the minimum required coverage.

If you must get high-risk car insurance or insurance through your state's automobile insurance plan, you can expect to pay more for coverage for a number of years. If you keep up your car insurance and avoid any further lapses, however, you will eventually qualify for better premiums.

Avoiding Future Lapses

You can avoid having another auto insurance lapse by:

- Making sure your registration and license information are current.

- Surrendering the plates for a car that you no longer own.