1 year auto insurance policy

Editor’s note: NerdWallet’s newest data on car insurance savings can be found here.

Editor’s note: NerdWallet’s newest data on car insurance savings can be found here.

If you think shopping for car insurance online is a hassle, you’re not alone.

In a NerdWallet survey, 88% of drivers find shopping for car insurance a frustrating experience because it’s time-consuming, difficult to compare prices or encroaches on their privacy. As a result, drivers who can’t effectively compare car insurance quotes miss out on significant savings every year.

Key Findings:

- American drivers are overpaying an average of $368 each year for car insurance.

- Within a given zip code, rates vary by 154% on average, allowing drivers to find an average of 32% in savings.

- Only 12% of drivers find car insurance shopping easy—leaving 88% with missed opportunities to find cheaper insurance.

Comparison shopping can help drivers save 32%

NerdWallet analyzed car insurance quotes for 1, 000 zip codes across the U.S. The wide range of quotes available even in one zip code shows there are opportunities for drivers to find substantial savings by comparison shopping.

» COMPARE: Car insurance quotes

For example, a hypothetical 40-year-old married male driver with a clean driving record is quoted at rates ranging from $1, 045 to $3, 048 for Stockdale, Texas, 78160. The typical price he would pay for auto insurance is $1, 436, but he can find $391 or 27% in savings with the cheapest $1, 045 premium.

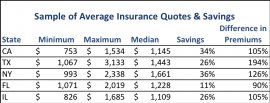

A snapshot of car insurance premiums in the five largest states shows the average savings and variability of premiums that drivers can expect to pay.

The average differences between the highest and lowest insurance premiums in each state are all triple-figure percentages, with the exception of Florida. For example, in Texas, the highest premium can be 194% higher than the lowest premium. This variance presents savings opportunities but can also be an overwhelming challenge for drivers who are looking for efficient ways to compare quotes.

Rates vary widely because insurance companies measure risk differently, said Michael Barry, vice president of media relations at the Insurance Information Institute.

“Insurers can weigh the same prospective policyholder differently. Some insurers will use credit-based insurance scores or another variable—such as job or education level—that would differentiate one applicant from another.”

“Insurers can weigh the same prospective policyholder differently. Some insurers will use credit-based insurance scores or another variable—such as job or education level—that would differentiate one applicant from another.”

Barry says rates vary state to state, depending on how urban or rural they are.

“Urban states have more things going on. There’s more traffic and higher probability of vandalism in urban states that you don’t have in largely rural areas.”

Online comparison shopping still frustrates drivers

According to a NerdWallet survey, 57% of drivers go online as the first step in finding car insurance quotes. However 50% of them find car insurance shopping time-consuming, 33% find it difficult to compare prices and 5% distrust advertised prices and have privacy concerns. Only 12% of drivers didn’t find car insurance shopping online difficult.

Vicky Chan, a benefits service manager from Edison, NJ, was looking for a new car insurance policy after it became too expensive to add two additional vehicles.

Chan said she did a lot of research by going to individual insurers’ websites but “It was time-consuming to enter in all the data, especially for three vehicles, ” on multiple sites.

Nathan Turner, a married 33-year-old home loan officer from Irvine, California, not only found it time-consuming to find quotes for two cars, but regrets having given too much of his personal information.

“I literally got eight to ten phone calls within the first hours from multiple insurance companies big and small, ” Turner said. “I was not prepared for all the calls, and overall it was a frustrating experience.”